As India strides into 2026, the domestic markets for gold and silver present a complex and multifaceted picture. These precious metals continue to be a critical component of household savings and a significant indicator of broader financial trends.

This is What You Need to Know

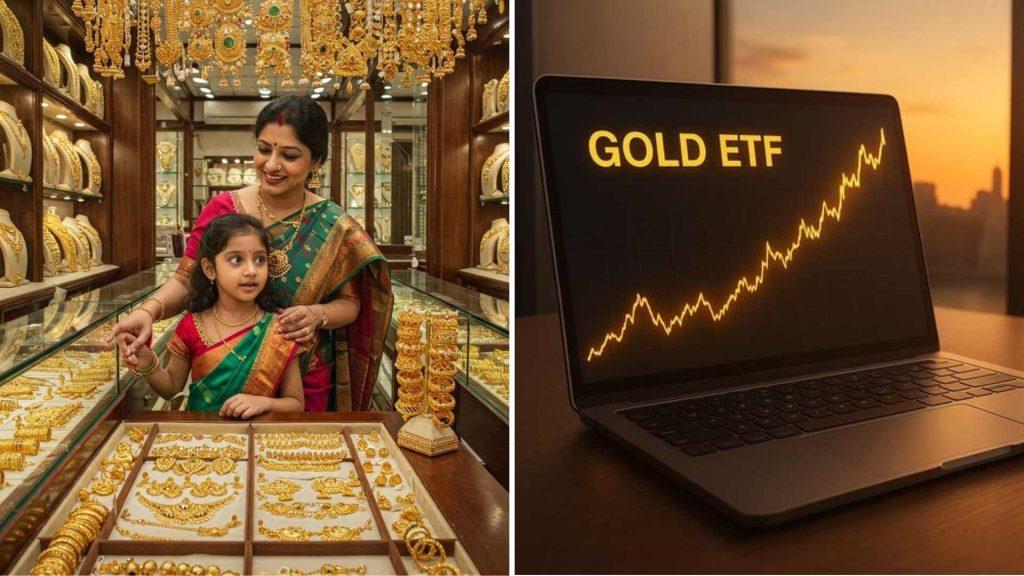

In India, gold and silver are much more than just shiny metals. They are woven into our culture, our weddings, and our way of saving for the future. As we move through 2026, the story of these metals is shaped by a mix of world events, government rules, and new ways of investing. Let’s break it down simply.

The Big World Influence

First and foremost, the starting point for gold and silver prices in India is the international market, where they are priced in US Dollars.

Right now, the world economy is in a cautious state. The scary high inflation of a few years ago has cooled down, but countries like the US are keeping interest rates high to control prices. This affects gold because when you can earn good interest in a bank, the attraction of holding gold (which pays none) is less. So, while people still buy gold for safety, its price rise has been steady, not explosive.

For us in India, the Rupee’s value is a crucial filter. Luckily, in 2026, a strong economy and good foreign investment have kept the rupee fairly stable against the dollar. This means that sometimes, even when gold prices shoot up globally, a stable rupee softens the blow for Indian buyers, making it relatively more affordable here.

How Government Policies are Shaping the Market for Gold & Silver?

The Sovereign Gold Bond (SGB) scheme is now a mature and popular choice. Instead of buying physical gold, you can buy these paper bonds from the government. They not only track the gold price but also pay you interest. This financialization of gold is slowly moving some investment demand away from physical jewellery and into these digital instruments. At the same time, shopping for gold has become more trustworthy. BIS Hallmarking is now the norm, guaranteeing the purity of your jewellery. This, along with the settled GST system, has made prices more transparent and uniform across different shops and cities.

Silver has an interesting story in 2026. It’s precious and also highly industrial. It’s used in solar panels, electronics, and electric vehicles, all sectors in which India is pushing hard to grow through its PLI schemes. This dual nature makes silver more volatile. When the world’s factories are busy, silver prices can rise faster than those of gold. But if there’s fear of an economic slowdown, silver can fall harder. For Indian investors, this makes silver a direct bet on the country’s industrial growth, but it’s a bumpier ride than gold.

How are Indians buying gold & Silver Now?

When it comes to buying, India has two parallel trends:

The Traditional Way: In rural and semi-urban areas, buying physical gold jewellery, especially for weddings and festivals, remains the strongest form of saving. This deep-rooted habit creates a solid ‘price floor’, when prices dip, people rush to buy, which supports the market.

The Modern Way: In cities, investors are choosing convenience. Gold ETFs (Exchange-Traded Funds), digital gold wallets, and SGBs are seeing steady growth. People like the ease of buying, selling, and holding these without worrying about storage or purity.

What's the Approach for the Rest of 2026?

- Global Central Banks: Their decisions on interest rates will be the biggest factor.

- The Indian Rupee: Its continued strength can keep local prices in check.

- Geopolitical Tensions: Any global uncertainty will trigger safe-haven buying, pushing prices up temporarily.

To Conclude

- Gold is a preserver of wealth, a cultural necessity, and a safety net for your portfolio.

- Silver is an industrial bet that can outperform but comes with higher volatility.